G7 Finance Ministers accused of 'not going far enough' in historic tax deal

By Susy Hodges

Finance Ministers from the G7 nations have reached a landmark deal to make multinational tech companies like Google and Amazon pay more tax. The deal could see billions of dollars flow into the coffers of governments, to pay off debts incurred during the Covid pandemic. But as Susy Hodges reports, campaigners and charities have criticized the governments for not going far enough.

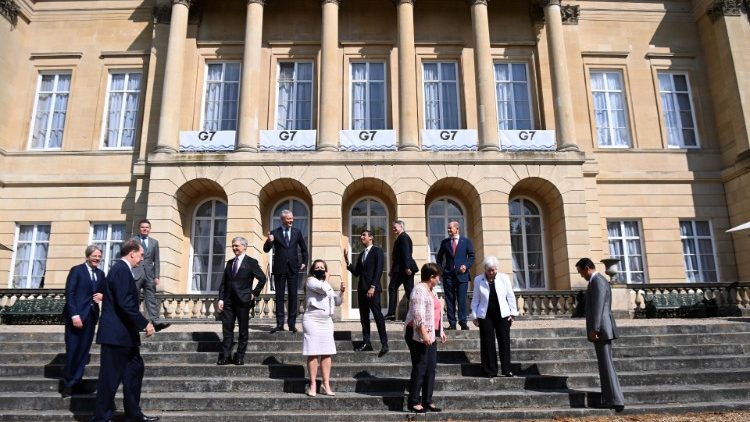

The deal was announced at the end of a two-day meeting in London attended by the finance ministers of the G7 group of wealthy nations, the United States, Canada, Britain, France, Germany, Italy, and Japan plus the EU. It followed more than eight years of talks that gained fresh impetus in recent months after proposals from the new U.S. administration.

The finance ministers agreed to back a minimum global corporate tax rate of at least 15 percent to be paid by multinational companies in each country where they operate. It is hoped this will reduce the incentive by giant tech companies such as Amazon, Facebook and Google to shift profits to low-tax offshore havens.

How tax revenues will be split is not finalized yet and any deal will also need to pass the U.S. Congress.

The G7 finance ministers also agreed to move towards making companies declare their environmental impact in a more standard way so investors can decide more easily whether to fund them.

Historical agreement 'to fit digital age'

British Finance Minister Rishi Sunak who chaired the meeting said the ministers had reached “an historic agreement to reform the global tax system to make it fit for the digital age.”

U.S. Treasury Secretary Janet Yellen said the commitment would end what she called a race to the bottom on global taxation. The German Finance Minister Olaf Scholtz said the deal was “bad news for tax havens around the world.”

But campaigners and aid groups have criticized the deal for not going far enough. The charity Oxfam said the G7 nations have set the bar for global tax “so low that companies can just step over it.” It said the deal was unfair as it would benefit G7 nations, where many of the big tech companies are headquartered, at the expense of poorer nations. Another campaign group called the deal “a turning point” but said the global tax system remained extremely unfair.

Thank you for reading our article. You can keep up-to-date by subscribing to our daily newsletter. Just click here